How Financially Prepared Are Brits for an Emergency?

New research from international finance guide, SWIFT.codes, reveals that nearly one in five (19%) adults in the UK say they feel “very well prepared” to deal with an emergency cost.

In reality, life rarely goes exactly to plan, and when the unexpected happens, financial preparedness can make all the difference. Financial emergencies can happen to anyone, whether you’re managing household expenses or supporting loved ones abroad. To do so you might need to find SWIFT codes to get the details of your international recipient.

To understand the true state of emergency preparedness in Britain today, we surveyed adults across the UK, exploring how much people have set aside for emergencies, how long they could manage without income, and whether they’ve ever had to rely on friends or family for support.

Key findings

- Over one in 10 (11%) UK adults have no money set aside for emergencies, leaving 89% with at least some form of emergency fund.

- Only 47% of people would be very confident covering a £500 cost without borrowing or asking for help.

- More than half (54%) of 18–24-year-olds say they would run out of money within a month if their income stopped, compared to 15% of those aged 65 and above.

- Nearly half (44%) of adults have relied on loved ones for emergency help, and almost one in eight (13%) have done so within the past year.

- Brits rate their own financial preparedness a seven out of 10, on average.

How prepared do people feel for an emergency?

Most people in the UK feel reasonably prepared for an emergency, but not completely confident. Three-quarters (75%) rate themselves a six or above out of 10.

Across the country, preparedness also varies by region:

- Northern Ireland (average score of 7.4) and the South East (7.2) have the highest preparedness scores in the UK.

- People in Cardiff (6.3) and Newcastle (6.4) feel the least ready to handle an emergency cost.

Preparedness tends to rise with age. Those aged 65 and over report the highest average score (7.8 out of 10), while under-24s average just 6.5, the lowest of any age group.

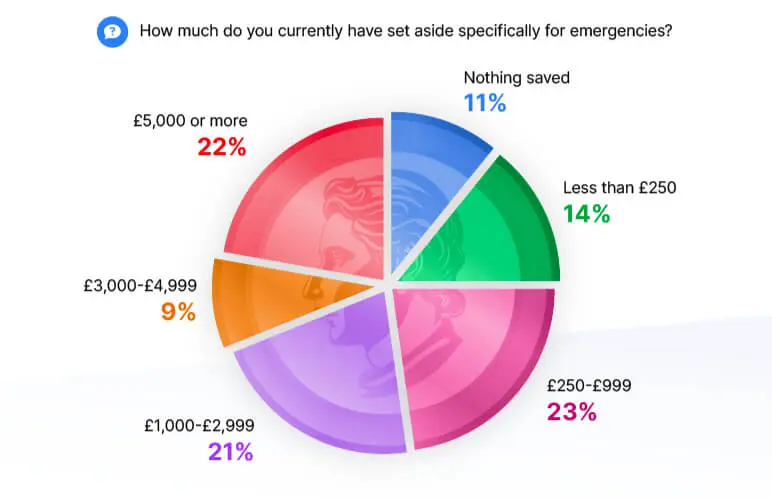

How much do people have saved for emergencies?

| How much do you currently have set aside specifically for emergencies? | |

|---|---|

| Nothing saved | 11% |

| Less than £250 | 14% |

| £250-£999 | 23% |

| £1,000-£2,999 | 21% |

| £3,000-£4,999 | 9% |

| £5,000 or more | 22% |

A quarter (25%) of UK adults have little to fall back on if a sudden expense arises. While 11% have no savings at all, a further 14% have less than £250 set aside.

At the other end of the scale, 22% have £5,000 or more saved, while around one in five people (21%) fall into the mid-range with between £1,000 and £2,999 set aside for emergencies.

Looking closer at the data highlights some clear differences between groups:

- Younger adults are most exposed. More than one in three (31%) under-24s have less than £250 saved, compared with just 21% of those aged 65 and over.

- People in Southampton are the least likely to have emergency funds. Over one in six (17%) adults in the city have no emergency savings, the highest proportion of any UK area.

- Women are more likely than men to have minimal savings. One in seven (13%) women have no money set aside, compared with 9% of men.

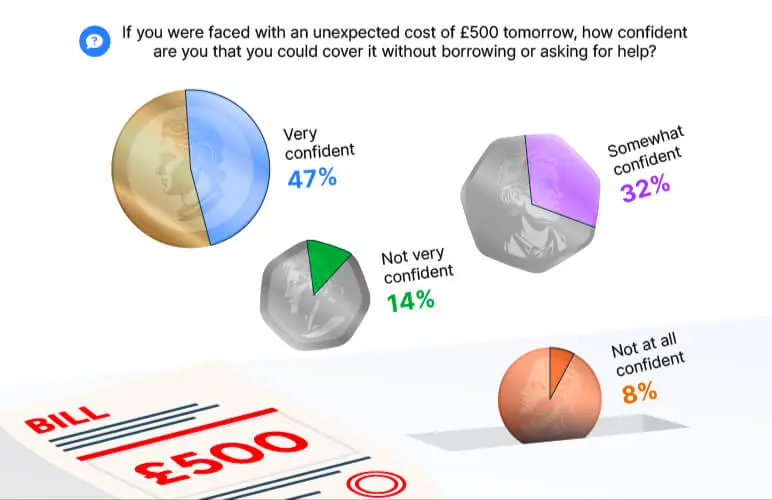

Could you handle a £500 emergency tomorrow?

| If you were faced with an unexpected cost of £500 tomorrow, how confident are you that you could cover it without borrowing or asking for help? | |

|---|---|

| Very confident | 47% |

| Quite confident | 32% |

| Not very confident | 14% |

| Not at all confident | 8% |

Almost half (47%) of UK adults say they would feel very confident covering a sudden £500 expense without outside help. Then, a further 32% feel somewhat confident.

However, more than one in five people (22%) admit they would struggle to pay for an unexpected cost without borrowing or asking for help.

Across the UK, people in Northern Ireland think they’re the most prepared, with 64% saying they’re very confident in handling an unexpected cost of £500. Elsewhere, one in 10 (10%) in South West England and Wales are not at all confident.

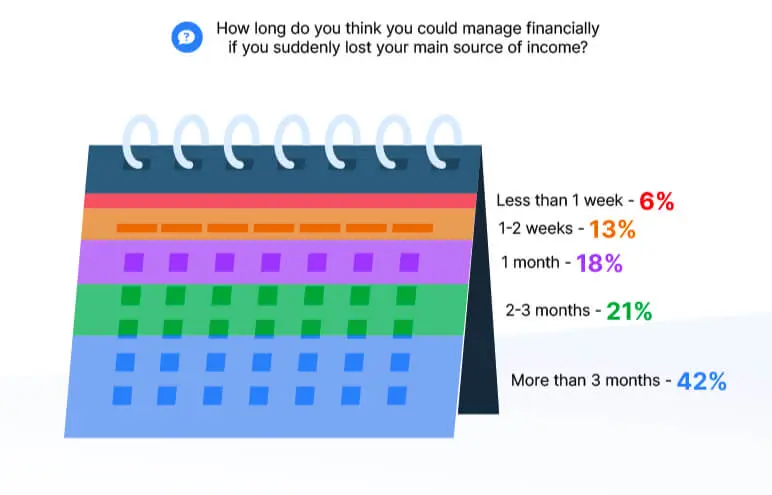

How long could you manage without income?

| How long do you think you could manage financially if you suddenly lost your main source of income? | |

|---|---|

| Less than 1 week | 6% |

| 1-2 weeks | 13% |

| 1 month | 18% |

| 2-3 months | 21% |

| More than 3 months | 42% |

For many households, financial stability would be short-lived if income suddenly stopped. Over a third (37%) of people in the UK say they could manage for a month or less, while 42% feel they could continue for more than three months without earnings.

The responses vary significantly between age groups:

- Older adults are far more financially resilient. Almost two-thirds (62%) of those aged 65 and over say they could manage for three months or more without income.

- Younger people are at greater risk. Over half (54%) of 18 to 24-year-olds say they would run out of money within a month.

Men are more likely than women to say they could manage for over three months (44% compared with 40%), while women are more likely to report they could cope for less than a month (39% compared with 36% of men).

When emergencies strike, who do we turn to?

| Have you ever had to rely on family members, friends, or loved ones to help cover an unexpected emergency cost? | |

|---|---|

| Yes, in the past year | 13% |

| Yes, but more than a year ago | 31% |

| No, never | 52% |

| Can't remember | 4% |

When the unexpected happens, support often comes from those closest to us. Over two-fifths of UK adults (44%) have relied on friends or family to cover an emergency cost at some point, including 13% who have done so within the past year.

The data also shows who is most likely to lean on others:

- Younger adults are most reliant on support from loved ones. Nearly two-thirds (64%) aged 25 to 34 have borrowed from friends or family, compared with just 20% of those aged 65 and over.

- Over half (52%) of the respondents in London and Newcastle have borrowed from a loved one, 10 percentage points higher than the national average of 42%.

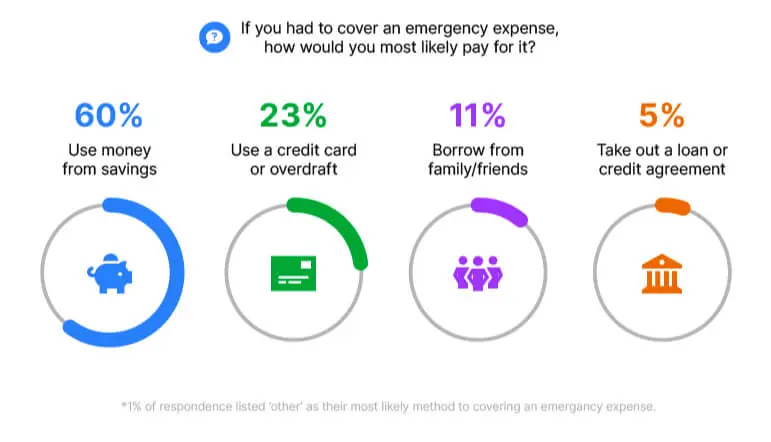

Saving vs borrowing

| If you had to cover an emergency expense, how would you most likely pay for it? Pick the main option. | |

|---|---|

| Use money from savings | 60% |

| Use a credit card or overdraft | 23% |

| Borrow from family/friends | 11% |

| Take out a loan or credit agreement | 5% |

| Other (please specify) | 1% |

Six in 10 (60%) UK adults say they would use savings to pay for an emergency, making it the most common way to handle unexpected costs.

However, not everyone has the same financial flexibility. Almost a quarter (23%) would rely on a credit card or overdraft, one in 10 (11%) would turn to family or friends, and a further 5% say they would take out a loan or credit agreement. While credit cards and overdraft facilities can be useful if paid off in full on time, they also present a risk of people falling into more debt to pay off an existing debt, this is often referred to as a debt trap or spiral.

How people choose to cover emergencies varies across the country:

- Savings are used most often in Scotland, where two-thirds (67%) would rely on them to cover an unexpected cost.

- People in Northern England are most likely to borrow from loved ones, with nearly one in five (18%) turning to family or friends for help.

- Credit cards and overdrafts are most relied upon in South West England, where over one-third (35%) say they would use them to handle an emergency.

- Loans are used most frequently in Wales, with 8% of people choosing this option during financial shocks.

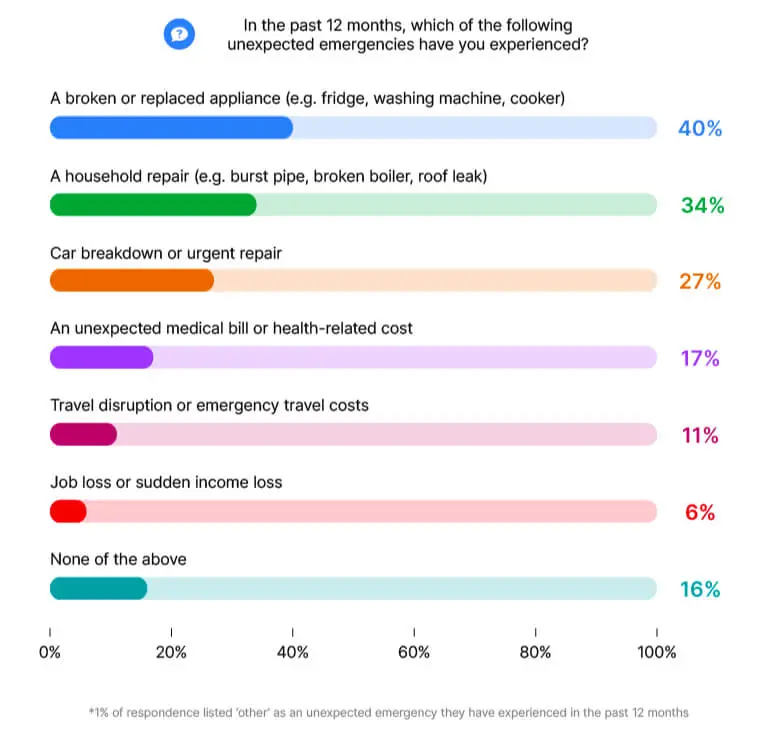

How common are emergencies in the UK?

| In the past 12 months, which of the following unexpected emergencies have you experienced? Select all that apply. | |

|---|---|

| A household repair (e.g. burst pipe, broken boiler, roof leak) | 34% |

| A broken or replaced appliance (e.g. fridge, washing machine, cooker) | 40% |

| An unexpected medical bill or health-related cost | 17% |

| Car breakdown or urgent repair | 27% |

| Job loss or sudden income loss | 6% |

| Travel disruption or emergency travel costs | 11% |

| Other | 1% |

| None of the above | 16% |

More than four in five (84%) people experienced at least one unexpected emergency in the past 12 months, ranging from household repairs to sudden medical or travel costs.

The most frequent issues are everyday but costly:

- Two in five (40%) people had to repair or replace a broken appliance, such as a washing machine or fridge. Rates were highest in Southampton (48%) and Leeds (47%),

- Over a third (34%) faced a household repair, including leaks, roof damage, or heating problems.

- More than a quarter (27%) experienced a car breakdown or urgent repair. Men were slightly more likely to face this bill than women, at 28% vs 26%.

Less frequent but often more disruptive events include unexpected medical bills (17%), travel-related emergencies (11%), and job losses or income shocks (6%).

The numbers behind the common emergencies

| Emergency | Annual frequency |

|---|---|

| A&E attendances* | 27,741,900 |

| Car breakdowns | 2,500,000 |

| Delayed flights | 693,000 |

| Boiler breakdowns | 512,629 |

| Redundancies | 455,957 |

| Fires | 142,494 |

| Burst pipes | 2,650 |

| White goods fires | 1,140 |

| *England only | |

The survey findings align with official figures showing just how common these events are across the UK:

- NHS statistics show that A&E departments record around 27.7 million attendances in England each year. This figure is higher than the share of people who reported an unexpected medical cost within the survey, at 17%, which is understandable given that many A&E visits do not result in personal out-of-pocket expenses or are covered through the NHS.

- RAC data says they attend 2.5 million car breakdowns annually. While a little lower than the 27% who reported a vehicle-related emergency, the difference could show the role of other roadside assistance providers and the number of drivers without breakdown cover who manage repairs independently.

- According to ONS data, nearly 456,000 redundancies occur annually, aligning with the 6% of individuals who face sudden income loss. These figures also underestimate the wider impact, as job losses often affect entire households, not just the person whose income stops.

How much should you have in savings?

There’s no single right answer to how much you should have in savings. Financial experts often recommend setting aside the equivalent of three to six months of essential expenses as a safety net. This amount can help cover unexpected costs such as home repairs, car issues, or a temporary loss of income.

If that goal feels ambitious, start smaller. Setting aside £10 or £20 a week can make a meaningful difference over time. The key is consistency. Building a regular savings habit helps make financial shocks easier to manage when they happen.

A good savings plan typically includes various types of funds. Together, they help you stay prepared for both everyday surprises and long-term goals:

- Emergency savings: Aim to keep the equivalent of three to six months of essential living costs in a separate, easy-access account. This is your safety net for unexpected expenses, such as home repairs, medical bills, or income loss.

- Short-term savings: Money set aside for goals within the next few years, like a holiday, a new car, or school costs. This can be kept in a regular savings account where it’s safe and readily accessible.

- Long-term savings: Plans that stretch beyond five years, such as retirement or a future home. These funds are often better suited to investment-based accounts or pension schemes that allow your money to grow over time.

Practical steps to help your family plan for the unexpected

Life can be unpredictable, from sudden home repairs to family emergencies, but having an emergency savings plan in place can make those moments less stressful and help you protect what matters most.

1. Build your emergency fund

Even a small buffer can make a big difference when an unexpected cost arises. Start small:

- Aim for an initial target of £250 to £500, then gradually build up to three months' expenses.

- Automate savings where possible. Setting up a standing order, even for a small weekly amount, can keep your progress steady.

- Use a dedicated savings or instant-access account so emergency money doesn't get mixed with day-to-day spending.

2. Make sure funds are easy to access

When emergencies happen, you don’t want to wait around for your funds. Set up instant transfer options:

- Keep at least one instant transfer account or payment method that lets you move money immediately when needed – whether that’s between your own accounts or to loved ones abroad.

- Review daily transfer and withdrawal limits in your banking or money transfer app before an emergency occurs.

3. Keep essential information organised

A few minutes of preparation now can save valuable time later. Create a shared folder (digital or paper) containing:

- Emergency contact numbers for family, healthcare, insurance, and utilities.

- Policy or account details for home, car, or travel insurance.

- Copies of important ID or travel documents.

- Current medical information or prescriptions for each family member.

Review this shared folder twice a year to keep everything up-to-date.

4. Strengthen your communication plan

In stressful situations, clear communication helps everyone stay calm. Plan who to contact first:

- Nominate one family member as the main emergency contact.

- Create a simple message group or list in your phone so you can reach people quickly.

- Make sure relatives abroad know how to reach you if something urgent happens on their side, too.

- If you often send or receive money internationally, note everyone’s preferred method and currency in advance.

5. Review your insurance and benefits

Check what cover you already have and where the gaps might be. Knowing exactly what’s covered helps avoid surprises when you need support most. Look at:

- Home and contents insurance (for leaks, fires, or appliance damage).

- Car breakdown cover.

- Health or travel insurance, especially if you or your family travel often.

- Employer-provided benefits or sick pay policies.

6. Create a simple action plan

When something goes wrong, having a quick checklist helps you stay focused.

- Step 1: Check safety first (health, home, immediate needs).

- Step 2: Access emergency funds if required.

- Step 3: Contact your insurer, service provider, or trusted money transfer partner.

- Step 4: Communicate with family and keep receipts or records.

Methodology

To understand how ready people in the UK are to handle the unexpected, we surveyed 1,500 adults across the country, as of October 24th, 2025, through TLF Research

The research explored how much people have set aside for emergencies, how confident they feel about managing sudden costs, and how long they could sustain themselves without income.

We also used the following sources to find the estimated annual frequencies of different types of emergencies:

- Car breakdowns

- Boiler breakdowns

- A&E attendances (England only)

- Burst pipes

- White goods fires

- Fires attended by fire and rescue services

- Job losses

- Flight delays

All data was collected in October 2025 and is correct as of then.

This publication is provided for general information purposes only and is not intended to cover all aspects of the topics discussed herein. This publication is not a substitute for seeking advice from an applicable specialist or professional. The content in this publication does not constitute legal, tax, or other professional advice.